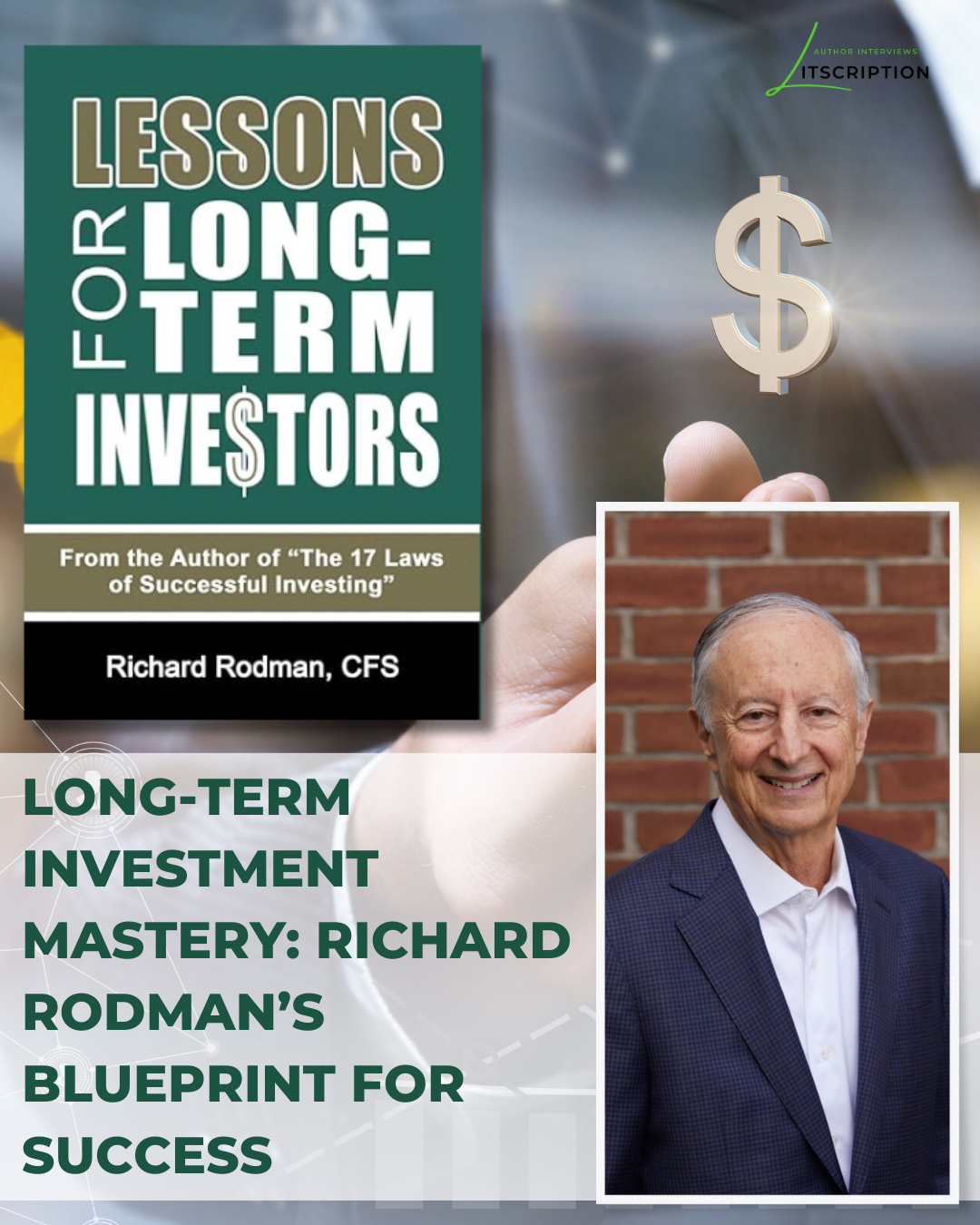

Richard Rodman, an experienced member of the intricate landscape of personal finance and investing, boasts a remarkable five-decade career. With an unwavering commitment to learning about financial intricacies, Rodman has dedicated his career to empowering a diverse spectrum of individuals, ranging from entrepreneurial minds to top-tier corporate leaders at renowned entities like Google. As the author behind Lessons for Long-Term Investors and a prolific advocate for financial literacy, his insights transcend mere advice. This interview serves as a portal into Rodman’s world, into the public’s imperative need for a long-term perspective in investing, providing invaluable glimpses into strategies, navigating volatile markets, and the enduring strength embedded in a principled long-term investment approach.

What motivated you to write Lessons for Long-Term Investors?

What motivated me to write this book is that on looking back over my 50+ year career I have seen a fair amount of people investing on their own. Without the perspective of long-term investing and overreacting to good and bad news, I thought that a reset was for much of the investing population to gain the knowledge and perspective to invest better.

Could you share a bit about your personal journey in the world of finance and investing? What inspired you to become interested in this field?

Could you share a bit about your personal journey in the world of finance and investing? What inspired you to become interested in this field?

Great question. About 60 years ago my father bought a stock that I followed in our local newspaper. One day, it disappeared. I asked why and my father said it went bankrupt. So I was fascinated by this and thought I should learn more about investing and so the journey began. I thought it was necessary if I wanted to have a better life.

Long-term investing requires a different mindset compared to short-term trading. What are some of the mental shifts that investors should make when transitioning to a long-term investment strategy?

In transferring from a short-term mentality to a long-term mentality it takes away that emotionalism associated with short-term thinking, which will be appealing to investors. This will give them a lot of the reasoning of why to make the change, as most investors get fed up with the emotional issues and difficulty eventually in short-term trading.

Budgeting is often considered the cornerstone of personal finance. How do you recommend individuals create and stick to a budget that aligns with their financial goals?

Yes, this is extremely important. What I say in the first section of the book which has 13 Laws of Investing is to pay yourself first each month. Make it a reasonable number. You will be surprised that you will be able to pay all your bills and invest as well. It is amazing how money falls into the cracks each month if you don’t have a plan.

Market volatility can test the resolve of long-term investors. How do you address the

topic of managing emotions and staying the course during turbulent market periods in

your book?

It is done two ways. First, when things get emotionally charged, ask yourself if your financial goals have changed. If your portfolio is built around long-term investing as it should be (hence the title of my book Lessons for Long-Term Investor, then short term swings shouldn’t matter and no action should be taken. In the words of Gene Farma Jr., a famous economist “Your money is like a bar of soap. The more you handle it the less you will have.” Secondly, as mentioned, trust history. In a down cycle just wait it out if nothing has changed fundamentally with your individual positions. A disciplined approach to investing will win the day. Yes, it is sometimes boring and sometimes maddening, but it does work.

Debt can be a significant financial challenge. How do you suggest people approach managing and reducing different types of debt effectively?

If you are paying 18% for instance on credit card debt, if you reduce that, it is like investing with a return of 18%, which is very good. So, get rid of all debt that carries a high interest rate first.

“Time in the market, not timing the market” is a common adage for long-term investors. Could you elaborate on this principle and discuss how you emphasize it in your book?

It is so true. In my 50+ years in this business I have never seen anyone be successful at it consistently. Many have tried and I am not sure why.

Risk and return are interconnected in investing. How do you explain the concept of risk to new investors, and how can they balance risk and potential returns?

A good question. Risk can be commensurate with return and vice-versa. Everyone is different but only experience in investing can help you reach your comfort zone over time. I sometimes look for a potential reward to be at least two times the risk.

Tax implications can significantly impact an investor’s returns. How does your book

guide readers on tax-efficient strategies for their long-term portfolios?

For the most part, I tend to ignore tax implications. It is one of the Laws in the book. Good decisions trump tax planning. That said, there are choices that pop up which need to be addressed. For example, if a stock needs to be sold and there is just one week to go before it is considered and long-term gain with less tax due, then maybe that is the best course.

What factors should individuals consider when deciding between a long-term investment approach and a short-term trading strategy?

Long Term works better for the vast majority of investors, hence my book Lessons for Long-

term Investors. It allows history to work for you over the long run, reduces risk and time spent on your portfolio.

In the ever-evolving landscape of finance, technological advancements can play a role in shaping investment strategies. How does your book tackle the integration of technology and data analytics in the context of long-term investing?

This is a wonderful question. My personal feeling is that artificial intelligence will have a role in investing now and mostly in the future. However, I am firmly of the belief that human intuition which is gained through real life experiences will be worth more than most technological advancements.

How do you convey the power of compounding to someone who is just starting to invest? What role does the length of their investment horizon play?

Get a hold of a compound interest table and it will answer all questions. Einstein was once asked what the greatest invention of mankind was. He answered, “compound interest”. Warren Buffet learned this many years ago.

Long-term goals often encompass retirement planning and financial security. Can you provide insights from your book on how readers can align their long-term investment strategies with their retirement aspirations?

Another good question. Time is our most important asset. As you get closer to retirement most individuals get more conservative in their investment choices. However, we are all living longer, so even if you are of retirement age there still needs to be planning done for quite a few years in most cases. I would stay with a decent amount of stocks in retirement (in addition to bonds and cash) depending on your risk tolerance.

Tax implications can significantly affect investment outcomes. What strategies do you advise for making investments tax-efficient?

I am not a big proponent of having tax planning get in the way of returns. The exceptions are around the margins. An example would be if you had a position that should be sold, but you could wait a small period of time to take advantage of long-term capital gains treatment (a holding period of over one year) to get a lower tax rate on the sale.

Setting clear financial goals is crucial. How can someone identify their short-term and long-term financial objectives and create a plan to achieve them?

As mentioned, set a predetermined level of savings each month to move to investments on a disciplined basis (and of course invest what you have currently over and above an emergency fund). Goal should be long-term. Of course, as we age, we do get more conservative most of the time, so adjusting the portfolio is important as well, since our goals might change to more short term at that point.

The financial landscape evolves. What are your recommendations for individuals to stay informed about new investment opportunities, regulations, and trends?

Just keep reading. Today everything is so available. Keep reading and learning about

everything, but specifically about fundamental and technical analysis. They are the cornerstone

of assembling the best possible portfolio.

Find the Author

Lessons for Long Term Investors

Master These Lessons and Become a Successful Investor!

Do you want to create more wealth? Do you want to maintain or even add to your standard of living now and during retirement? Now you can if you follow the concepts of this book. With this book, noted investment consultant Richard Rodman shows you:

Do you want to create more wealth? Do you want to maintain or even add to your standard of living now and during retirement? Now you can if you follow the concepts of this book. With this book, noted investment consultant Richard Rodman shows you:

- A wealth creation formula that WORKS!

- How to manage fear and greed–the two emotions that preclude sound investing

- How to put financial markets in their proper perspective and not in the perspective of the media, which mostly reports on short term market swings

- How to capitalize on bad news and market turmoil

This book is a distillation of over 50 years of sound investment advice and practice. It is a companion book to Rodman’s first book, The 17 Laws of Successful Investing, and companion text to his popular seminar, How to Create and Manage Wealth, as well as continuing education material for CPAs. In clear language and powerful examples compiled from many years of his newsletters, Rodman makes long-term investing understandable, easy, and attainable for virtually anyone in any income bracket. In these pages you will hopefully discover a new financial reality in today’s tumultuous world. Your future may actually depend on following these time-honored concepts. Ignore them at your own financial risks.